Event Recap: Exploring Homeownership and the American Dream in the Disability Community

By Katherine Lewis, Content Manager at Diversability

Event poster with round photos of the five panelists in a row with their name, pronouns, and title below. Dark blue text above reads “Wednesday, June 16, 2021, 7:00 pm ET; Diversability Unplugged: Disability Homeownership & the American Dream".” Below the photos text reads “ASL interpretation/auto-captioning provided.” Diversability and Blend logos bottom left on a technicolor strip.

On Wednesday, June 16, 2021, Diversability partnered with Blend for our June Unplugged event titled Diversability Unplugged: Disability Homeownership and the American Dream. This event brought members of the Blend and Diversability teams together, along with four panelists from the disability community, for an important conversation about homeownership and the disability community. This included Ashley Jacobson, a disability rights attorney living with physical disability in the state of Michigan; Danh Trang, a Senior Product Manager at Mux; Nicole Weitzman, a Physical Therapist Assistant and homeowner living in the greater Phoenix, AZ area; and Angela Fox, a Maryland Attorney by trade and a mediator for the federal government. The conversation was moderated by Emily Bilbao, part of the Strategic Operations team at Blend.

Ahead of the event, we shared a post with more details on why we were excited about hosting this event with Blend.

About Blend

Blend’s cloud banking platform helps lenders like Wells Fargo, U.S. Bank, and over 290 other financial service firms acquire more customers, increase productivity, deepen relationships, and make lending more accessible for all. Diversability is excited to be partnering with Blend for this event, as we are aligned with Blend’s commitment to equity and accessibility, because access to opportunity is key to economic mobility and transferable wealth. We believe that Blend is one tool that serves as a catalyst for that.By helping customers process an average of more than $4 billion in loans per day, Blend enables millions of consumers to purchase homes and gain access to the capital they need to lead better lives. A commitment to digital banking that you can access anytime, anywhere is helping drive necessary change in the financial services industry so that the 57% of our community members polled can one day buy the home of their dreams.

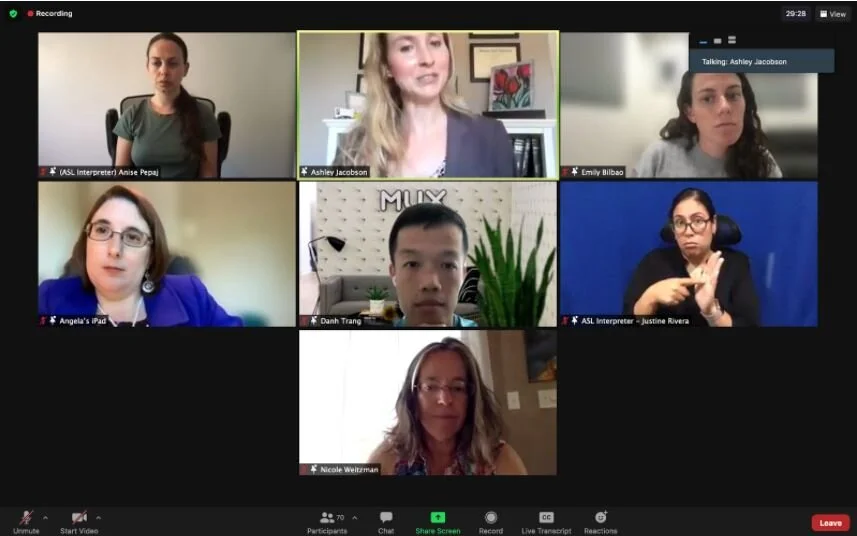

Screenshot of the event Zoom call with all panelists, hosts, and ASL interpreters shown.

We spent the session exploring the unique experience of the disabled community in the quest for homeownership, systemic barriers to homeownership, and more. Panelists answered a number of targeted questions, shared personal stories, and engaged with attendees in a Q&A session to close out the event.

Diversability’s content manager Katherine Lewis kicked off the evening by welcoming attendees and sharing more about Diversability’s work. Blend’s Antonia Ford then introduced Blend’s work and explained why they believe accessible financing is so important. Emily Bilbao, the event moderator, as well as the four panelists then briefly introduced themselves before diving into the evening’s topics.

Barriers to Disability Homeownership

Panelists were asked to describe unique requirements that disabled people face in the home purchase and home modification process. Angela Fox began by highlighting the data surrounding homeownership assistance programs within marginalized communities, making note that despite the fact that the disability community has a substantial population of low-income members (approximately ⅓), the vast majority do not fit into the necessary income brackets required for traditional assistance programs. And unlike other minority groups, there is no dedicated assistance program for those in the disability community who do not fit into this small subset. In fact, only around 11 states in the U.S. have a disability-oriented housing program. While 11 states currently have programs in place to help disabled people own and modify homes, most are offered to specific subgroups of the disability community - meaning to qualify the applicant must be a disabled person and a veteran, a disabled person over 65, have a child with a disability, or meet some other additional qualifier.

Additionally, disabled homeowners must face the harsh reality that there are simply very few accessible homes on the market. This number currently hovers around 2% of homes on the market at any given time. The vast majority require substantial modifications in order to be a viable option for disabled home-buyers - a reality that is not only a logistical hurdle, but a financial and legal one as well.

Legal Protections

The legal protections for disabled home buyers are both concrete and elusive. Ashley Jacobson discussed the Fair Housing Act, ADA, and Rehab Act, noting that certain parts of these, as well as other legislations vary by state. This can make the buying process confusing for prospective buyers, sellers, and lenders alike. There are also a number of legal exceptions specific to the housing market. The most notable being marijuana. Even in states where marijuana is recreationally legal, housing lenders, HOAs, and sellers reserve the right to deny buyers based on use - even when it is medically necessary. So although protections exist, it isn’t always as simple in practice. This brought up the topic of housing discrimination. Often, despite legislative mandate, brokerages, landlords, etc. don’t want to modify homes and often don’t make the process palatable or accessible. There’s an assumption that young disabled people won’t ever be homeowners so they’re not taught about credit, lending, etc. creating a substantial knowledge gap as well.

A number of discrimination scenarios were discussed. Lack of awareness leaves people without real options. For Nic Weitzman, this meant losing her home and shouldering immense debt that ruined her credit for years all because the lending service would not accept her calls from a relay service she required as a deaf person. She escalated her case in a number of ways - hiring an attorney, and going so far as to refuse to pay her mortgage to demand her legally protected accommodations. Although the firm later amended their practices, it was too late for her. Ashley, who has had experience working with similar cases, made a point to mention that finding a lawyer in your area is not simple for the disabled. Many don’t understand disability-specific issues and laws or keep up properly with their updates. She and Angela suggested asking a few key questions if you choose to seek legal advice or representation. Ask if they know about the amendments of the ADA and “What’s the difference between ADA and Fair Housing Act?” While it’s not a perfect solution, it can weed out those who actually know disability law and those who are just getting by.

Technology

Danh Trang opened this segment by explaining the three pillars he views as the most significant to disability homeownership: Society, Government, and Technology. He explained that society is the most difficult barrier to overcome; it is rooted in a great deal of internalized stigma and narrative, as well as a general lack of awareness. Government, while an important asset in the form of assistance programs and legislation, often is bogged down by bureaucracy and red tape. This is where technology can fill in the blanks. Tech helps level the playing field for ensuring the right resources get to the right people. It has the power to enhance government programs, make them more accessible and help them where they may be falling short. In the housing process, this can include mobile housing applications, digital signature options, integrations with third party providers that assist in providing certain home-buying criteria such as income, credit, etc., and storing important data that may become necessary later in the homeownership experience. One promising arena for this is the home-answer-service industry which allows information about the home and its features to be stored by lenders and be sent to third-party service providers in real time. An example being the model, serial number, and warranty data of a refrigerator that has broken. This information can be sent to repair services quickly, making managing a home that much more accessible than ever before.

Planning for the Long Term

The panel then discussed the importance of long-term financial and personal planning. Danh suggested becoming educated in disability issues and creating a toolbox on the microsteps of the housing process. Don’t assume that realtors, lenders, bankers, etc. have any in-depth understanding of disability housing needs, disability language, universal design, etc. He also was adamant that if you’re even thinking about buying a home, to start now, and start early. You never know when you’ll want to buy a house. And the process for us is more complex, so take that into account. They also discussed the double-edged sword nature of homeownership for disabled people. Having a disability is expensive. And to many, the stability and prospect of an asset like a home is important. Yet at the same time, it’s more difficult to save for the upfront and long-term financial obligations of buying a home. Considering the income thresholds of certain assistance programs and weighing the cost to benefit ratios of income level fluctuations is an important step. Angela, for instance, declined a promotion at work to avoid disqualifying herself from a county program that was assisting her during her home buying journey. She was able to later take more liberty with her employment opportunities after they were no longer in danger of preventing her from buying her home. These types of considerations, while they may seem insignificant now, can make the difference between accessible homeownership and unforeseen obstacles.

As a potential solution, Danh made us aware that a growing number of companies enable what is called fractional ownership. Essentially, they assist in putting a down payment on a home for you and participate in the upside of the home as well. While this option may not be ideal, it can be a meaningful step towards homeownership to those who may not have the financial means to otherwise and are worth considering. As these types of partnerships continue to grow, they open the opportunity for earlier ownership and asset development, and ultimately empowerment.

—————

Attendees shared that they appreciated that the panelists could speak from their own experience and had a broad variety of expertise and knowledge.

Watch a replay of the event on YouTube and continue the conversation in our online community.